YOU Staking Pool

Staking YOU tokens#

Holders of YOU tokens, the youves governance tokens, can choose to stake their tokens in the YOU staking pool. Staking means locking these tokens for a certain period of time. Staking YOU tokens comes with two benefits for the staking users:

- YOU stakes can participate in the youves governance process

- YOU stakes accrue platform rewards from fees and interest rate payments.

YOU Staking Pool V3 - Commitment pool for the youves Token#

The YOU Staking Pool V3 aka "The Commitment Pool" supersedes its predecessor, the YOU Staking Pool V2, which was formerly known as the "Unified Staking Pool". Unlike the V2 pool, which reduced rewards if a user unstaked within 180 days of staking, the V3 pool adopts a different approach to locking funds. The contract can be found on KT1ENJfVK98HTRfxjFKPqu1R7tFwXVjmLAo2.

The Commitment#

When users opt to stake their YOU tokens using the V3 contract, they must choose a cooldown period. The Cooldown Period represents the duration during which their tokens remain locked after initiating a transaction to unstake them from the V3 pool. The cooldown period is a countdown that starts when the entrypoint enter_cooldownis called on the YOU Staking Contract V3. The maximum selectable length of the cooldown period is 32 epochs of 28 days each, in total 896 days or roughly 2.5 years. Users have the flexibility to select a cooldown period anywhere between 0 and a maximum 77'414'400 seconds (896 days).

By choosing a cooldown period for their stakes, users commit their long term support to the platform. Consequently, depending of the chosen cooldown period, users will receive more rewards and bigger vote weights than other stakers, who selected shorter cooldown periods. Users can have more than one stake and assign different cooldown periods to them. So a user could decide to stake some of the YOU tokens for a long term, while choosing a short cooldown period for another stake. In an other example, a user could decide to split their YOU holdings into 5 stakes of the same size and assign different cooldown periods to it, in order to stay flexible and at least partially liquid.

Factors influenced by the chosen Cooldown Period lenght#

Since the cooldown period serves as a means to express the staker's long term commitment to the platform, the selected length of the cooldown period significantly influences two crucial factors or weights which are applied to the users stake:

1. The Reward Weight (expressed as reward_weight)#

The reward_weight expresses a percentage of rewards to which a user is entitled, relative to the rewards they would receive if they selected the maximum length of the cooldown period.

When commiting a stake, the initial reward_weight of the stake is set as the following:

rewardWeight = (selectedCooldownDuration / maxCooldownDuration) * stakedAmount Here's an example:

(38'707'200s / 77'414'400s) * 1000 = 500This user staked 1000 YOU tokens and selected half of the maximum cooldown period (38'707'200 seconds or 448 days) as commitment. Consequently, this stake's `reward_weight` is set to 500, which is 50% of the maximum possible reward weight for this fresh stake of 1000 YOUs.

In order to decide how much of the incoming rewards a stake is entitled to, the V3 contract compares the stake size of a single stake to the sum of all stakes and then applies the reward_weight to it in order to calculate the percentage of rewards that given stake in the pool is entitled to.

Depending on the size of the stake and the chosen cooldown period, the reward_weight will vary. The allocation follows a linear pattern: If a user selects the maximum cooldown period, their Reward Weight will encompass 100% of their pro rata rewards for the duration of their active stake. If the user opts for only 50% of the maximum cooldown period (roughly 448d), their reward_weight will constitute 50% of the possible maximum of rewards for this stake. The rewards accumulated by a stake is directly proportional to the selected cooldown duration. The allocation of rewards per number of chosen epochs is linear.

On the new YOU staking contract a stake's Reward Weight is tracked as the reward_weight.

2. The Governance Vote Weight (expressed as vote_weight)#

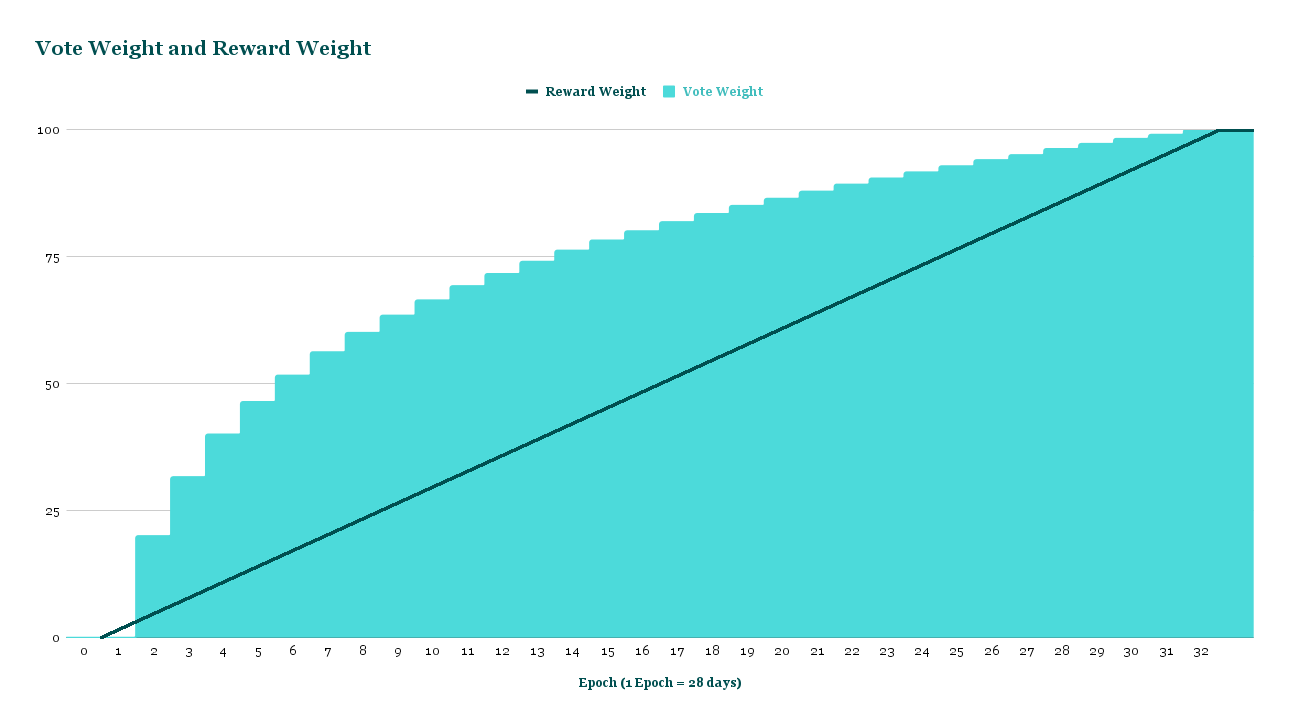

Similar to the Reward Weight, the user's Governance Vote Weight will be determined which is expressed as , vote_weight on the contract (check view get_vote_details. But instead of a linear distribution, a logaritmic curve is used to determine the vote weight of a stake, dependent on the chosen cooldown period. The longer the selected cooldown period, the bigger a user's vote weight. The bigger a users vote weight, the more his votes count in a youves governance vote on the youves DAO contract.

The allocation of vote weight follows a binary logaritmic curve (log2 n) which is segmented in 32 epochs of 28 days each. Each epoch has a certain vote weight assigned, derived from the logarithmic curve.

| cooldown period selected | assigned stake_weight factor | stake_weight percentage |

|---|---|---|

| 1 epoch (28 days) | 0 | 0% |

| 2 epochs (56 days) | 1 | 20% |

| 4 epochs (112 days) | 2 | 40% |

| 8 epochs (224 days) | 3 | 60% |

| 16 epochs (448 days) | 4 | 80% |

| 32 epochs (896 days) | 5 | 100% |

Mapped to 32 epochs, this results in the following stake_weight and reward_weight percentages per epoch, depending on the selected cooldown period:

*(click to enlarge)*

*(click to enlarge)*For the example user from above, who selected half of the maximum cooldown period as his commitment length, the stake_weight would be 4. This equals 80% of the maximum vote weight.

Users will be able to chose any cooldown period, but the smart contract will assign it to the epoch this cooldown period falls in.

In order to determine the the voting power of a stake, this stake_weight is applied to the users stake. A stakes voting power (number of votes) is calculated like this:

votes = (initialStake + accumulatedRewards) * voteWeightPercentageParameter change during the Cooldown period#

When a user calls enter_cooldown for a stake, the selected cooldown period starts for that stake. During the cooldown period, one of the above parameters will change:

Reward Weight is halved#

When the cooldown period starts, the Reward Weight (reward_weight) associated with a user's stake is set to 50% of its preceding value. This adjustment persists until the cooldown period ends, at which point the user becomes eligible to claim their rewards. These rewards encompass the gains accumulated by their stake during both the initial staking period and the subsequent cooldown period.

Governance Vote Weight remains the same#

A user who triggered the cooldown period on a stake, will still be able to vote with that stake at the same stake_weight as before. Note, that a user cannot trigger cooldown while his stake is locked in the governance contract (eg. during the voting phase of a YIP).

Recommitting during a cooldown#

Once a cooldown period on a stake has started and is running, a user can always recommit the stake and reenter the pool. The previously selected cooldown period of this stake will be resetted. Consequently, the reward_weight will be set back to it's previous value.

After the Cooldown period#

Withdrawing a stake#

Once the cooldown period ended, the stake continues to earn rewards as if it still was in the cooldown, but a user can and should withdraw his stake now. By withdrawing, the user will recover the amount of YOU he is currently entitled to. In order to calculate a users stake, the contract calculates the following:

withdrawalAmount = initialStake + accumulatedRewardsUsers need to withdraw their stake within the timespan defined in max_withdraw_delay, otherwise they risk to loose a part of their stake and rewards:

Kickout#

After the cooldown period ran out, a user needs to withdraw his stake within the timespan specified in max_withdraw_delay. If the user doesn't withdraw his stake within that timeframe, other users can kick the stake out, by calling the kickout entrypoint and providing the stake's ID. Upon kickout the user's tokens from the stake, including the accumulated rewards, will be transferred back to the original stake owner, as if it was withdrawn, but the user initiating the kickout will receive a reward that consists of a percetage of the affected stake's accumulated rewards, as defined in kicker_reward_ratio.

This means users need to observe the cooldown period and withdraw actively in order to retain the full balance of the stake and it's rewards. Otherwise the kicker will receive the defined percentage of the accumulated rewards of the kicked out stake.

Administrators#

As the V3 Staking Pool allows to have multiple administrators, the youves keyholders will retain administrative rights at the beginning. The community could still decide to remove the keyholders from the list of admins.

Stakes#

In order to be able to flexibly manage the YOU stakes, the unified staking pool allows to create multiple stakes with different cooldown periods which can be claimed independently. Users can vote with all of their stakes, independent of number, size or chosen parameters.

Rewards and YOU buybacks#

YOU stakers may claim a share of the platform staking rewards in proportion to their share of the staking pool and the selected cooldown period for their stake. Each second the platform staking rewards are allocated to the holders of staked governance tokens. The YOU staking pool will pay rewards in YOU tokens that are purchased on the markets by swapping revenues from individual tracker tokens, as long as the market impact of trading is not too big and the pegs of the tracker tokens hold. These rewards are collected on a collector contract, swapped to YOU tokens and forwarded to the YOU staking pool.

- Tracker and other involved token rewards (interest rate payments, trading fees, minting fees etc.) are collected on a collector contract with predefined ability to swap tokens on specific dexes

- Four times a day, a new five minute trading window will start.

- During 12 hours before the beginning of each trading window, the following aggregate values are observed:

- The median of hourly values of the observed pair.

- Based on the information, the platform aims to swap the accumulated staking reward share amounts on each tracker token address against YOU tokens on an exchange. This includes uUSD, uDEFI, uBTC and any potential other tracker tokens and also the fee earnings for the flat-curve DEX. For each token this trading will be done as long as the both of the following conditions are fulfilled:

- The specific tracker token is no more than 2% off its soft peg.

- The token price did not move by more than 5% vs. the observed median.

- If the full amount on an address of a specific tracker token cannot be swapped without violating the above condition, then only a fraction of the specific tracker token will be swapped up until the point where the condition starts to be breached.

- Any remaining tracker tokens that cannot be swapped will be retained on the address until the next trading window.

- YOU tokens acquired by the contract forwarded the YOU staking contract as rewards.

- YOU token holders that decide to unstake their YOU holdings at any point in time will receive the swapped YOU tokens which were allocated to their YOU holdings, subject to the conditions of participation.

DAO Contract V2#

The YOU Staking Contract V3 is deployed with a specific DAO contract.